In retail and e-commerce, financial accuracy is the foundation of trust. Every transaction, refund and adjustment must line up correctly across different systems. This task is far from simple. With multiple channels, rising return volumes and a mix of payment methods, businesses today face a serious challenge. That is payment reconciliation.

Manual methods that once worked are now stretched to their limits. For scaling businesses, automation is no longer optional. It is fast becoming the only way to ensure accuracy, speed and control in financial operations.

Payment Reconciliation: Understanding the Challenge

Modern commerce operates across diverse channels. A customer might purchase online but return the item in-store. Each system records transactions in different formats. It leaves the Finance team to try to piece everything together.

Research by Ernst & Young highlights the scale of this issue. Finance departments spend almost 60% of their resources managing transaction-heavy processes. That is valuable time that could be better invested in driving growth.

The Real Cost of Manual Payment Reconciliation

Manual payment reconciliation comes with hidden costs. These are not just about time but also about accuracy and missed opportunities.

Financial Impact

- Revenue loss: Errors in reconciliation cost banks an average of $2.1 million per incident.

- Resource allocation: Finance teams spend 30% of their time on manual transaction matching.

- Processing delays: Making a single transaction can take 45 to 60 minutes.

Operational Challenges

- Manual methods can process just 5 to 10 transactions an hour, and errors are common.

- Retailers often spend weeks reconciling monthly ledgers. It leads to delays in reporting and slows decision-making.

Why Is Payment Reconciliation So Difficult?

The challenge lies in the fragmented nature of today’s retail systems. A single purchase can affect multiple platforms. Consider the following obstacles:

Data format differences: Systems log transactions in different ways.

Timing differences: Settlement cycles vary.

- Card payments: T+2 to T+3

- Digital wallets: Same-day

- Bank transfers: T+1 to T+3

Cross-channel complexity: Returns add another layer.

- Online returns occur 17.6% of the time.

- In-store returns occur 10.02% of the time.

- Each return goes through the payment processor, POS system, inventory platform and general ledger.

Each system speaks a different language, which makes reconciliation complicated. The process often leads to mistakes and added delays.

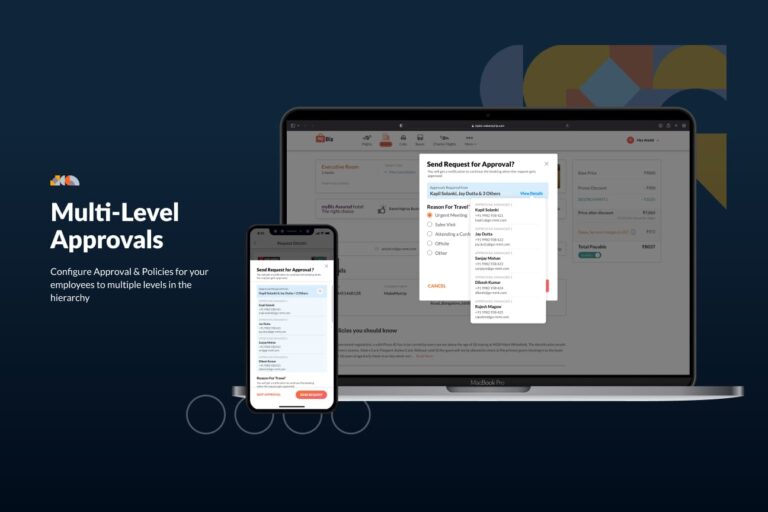

Automation With Hyperswitch

Hyperswitch, offered by partners like Juspay, is designed to address these challenges directly. Handling over 200 million transactions daily, Hyperswitch acts as a payments bridge. It aligns data across systems in real time.

Here is how it works in practice:

- It identifies the original transaction.

- It matches it with the return, regardless of system or payment method.

- It updates all accounts instantly.

- It highlights discrepancies for quick validation.

By automating these steps, Hyperswitch reduces complexity and gives businesses control over their financial data.

Tangible Results With Automation

Businesses adopting automated payment reconciliation see measurable benefits:

- Faster cycles: Reconciliation time reduced from hours to minutes.

- Fewer errors: Accuracy improved, with error rates falling below 0.5%.

- Time savings: Finance teams take up to 75% of their time.

- Efficiency gains: Transaction matching time is reduced from 45-60 minutes to just 5-10 minutes.

These improvements change payment reconciliation from a hurdle into a process that adds real value.

An example can be:

A leading online travel agency struggled with reconciliation across multiple currencies, tax rules, and settlement formats. By adopting Hyperswitch, the agency achieved:

- 60% improvement in operational efficiency

- 99.5% financial accuracy

- Seamless integration of data across regions

- A single settlement file that streamlined finance operations

What began as a pilot in two areas is now being scaled across the organisation.

Moving Towards Automation

If you’re looking to automate payment reconciliation, a step-by-step approach works best for you.

- Assessment: Map out your payment flows, spot key obstacles and set clear goals for yourself.

- Transition: Start with one processor or channel. Gradually expand step by step, and train your finance team as you go.

- Measurement: Track KPIs such as processing times, error rates and cost savings. Use these insights to adjust your systems for continuous improvement.

Preparing For the Future

Retail returns are projected to reach more than $890 billion in 2025. This highlights why modern payment reconciliation is not just a present need but a future investment.

By using automation tools like Hyperswitch, you can scale, handle higher transaction volumes, and maintain accuracy without slowing down. By freeing your finance team from manual work, you can focus more on growth, delivering customer value, and strategy.

Summarising

For scaling businesses, payment reconciliation is no longer an option. It is essential. It provides accuracy, saves time, and ensures control over financial data. With solutions like Juspay’s Hyperswitch, businesses can move from solving puzzles every day to running smooth, reliable operations.

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.