The finance industry has been one of the biggest beneficiaries of technology and modern app design. Being able to handle money in a digital, more seamless way has added trillions to the global economy, as it allows for more and faster transactions, as well as sending gifts, converting wages, and travelling abroad.

Lengthy bank visits are no longer necessary. And even if you need to transfer money from Canada to the Philippines, in which the remittance would be received as cash, it’s still a service that online specialists have begun to shine in.

Speed and instant gratification

Perhaps the biggest advantage of modern remittance and money transfer is the speed. Traditional bank wire transfers, even to this day, can take several business days to complete. It’s hard to believe but banks have become sluggish, with bloated legacy systems and outdated infrastructure, leaving recipients waiting anxiously for funds. Digital challengers, however, can process transactions within minutes or hours.

Unmatched convenience and accessibility

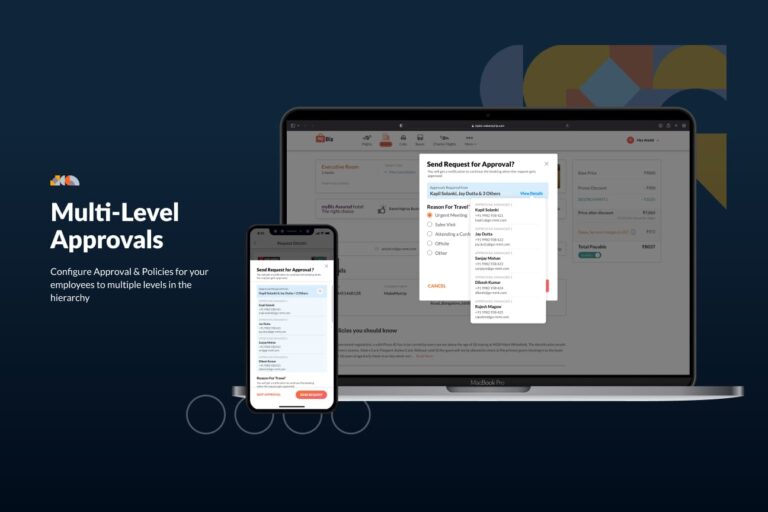

Digital platforms operate around the clock, and by nature they are never “off”. It eliminates the constraints of banking hours and holidays, and their customer service is set up to reflect this. Users can initiate transfers from anywhere with an internet connection, whether from their smartphone during a lunch break or from their computer at home late at night. This 24/7 accessibility means you’re never bound by traditional banking schedules when urgent financial needs arise.

The user-friendly interfaces of modern digital platforms also makes the entire process far more intuitive and friendly, even for those who aren’t particularly tech-savvy. Sometimes, just having a phone number in your contacts is enough to set up their recipient details. Step-by-step guidance exists, and everything works a little more smoothly.

Cost-effectiveness and transparent pricing

Online money transfers, through digital platforms like Ria Money, typically have far more competitive exchange rates and lower fees compared to banks. Why? Because it’s their entire business model and a point of competition, whereas banks make most of their money through mortgage products and investments.

Many platforms display all costs upfront, which makes a change, including exchange rate margins and transfer fees, eliminating hidden charges that often surprise customers.

Global reach and flexibility

Digital platforms have established networks that span continents, specializing in certain markets to provide the best service possible. This means that no currency is too exotic to access unlike with banks, which are often far more prohibitive. This global reach, combined with multiple payout options including bank deposits, cash pickup locations, and mobile wallet transfers, provides recipients with flexibility in how they receive their funds.

Unlike traditional methods that leave customers in the dark about transaction status, digital platforms have real-time updates throughout the process. This can settle the nerves about sending large amounts to far-flung countries.

Going digital

Digital money transfer platforms have changed the way we handle money – from savings pots and investing to remittance and exchange. By opting out of bank services, we can seek much more efficient, modern services that compete on innovation, speed and cost, while banks continue to live off goodwill, loyalty and being a one-stop shop.

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.