Introduction

What makes a cornerstone for a business thrive is effective money management. Two essential elements have become crucial tools for enterprises in today’s financial era, and they are Auto Debit and Buy Now, Pay Later (BNPL). This article will dive into analysing the relationship between BNPL and sales development as well as the critical function that Auto Debit plays within the BNPL framework and also examine the careful balance needed to include these components into a company’s financial portfolio.

How is BNPL Helping to Increase Business Revenue?

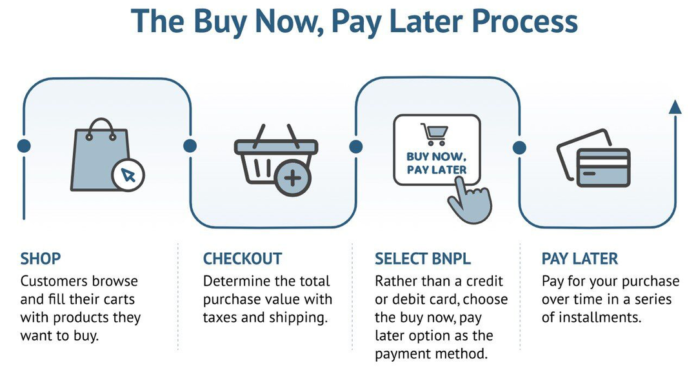

The full form of BNPL stands for Buy Now, Pay Later, gives customers the option to make instant purchases and spread out their payments over time, completely changing the conventional payment approach. Let’s take a look into how BNPL helps in boosting business revenue as follows:

- Expanding Market Reach:

BNPL has changed how consumers make purchases by removing obstacles to upfront payment. This has attracted a broader audience, especially those who need additional time to send payments right now. Companies can reach out to new customers, which can boost sales by extending the market’s reach.

- Improving Conversion Rates:

This option provides consumers with payment flexibility, which enhances the conversion rates. Customers are more likely to finish what they buy when they have the option to pay later or in instalments. This progress in conversion rates helps businesses achieve increased income and sales.

- Facilitating Upselling and Cross-selling:

BNPL creates chances for companies to promote cross-selling and upselling. Customers are more willing to explore other goods or services when they have access to deferred payment options. Using intelligent upselling techniques raises overall revenue in addition to the average transaction value.

- Building Customer Loyalty:

What fosters loyalty is BNPL’s customer-centric approach. Businesses can now offer convenient payment options and build lasting relationships by aligning the preferences of customers. What makes a brand stand out for services and advocate for more is what contributes to sustained revenue growth. This makes satisfied customers return for more purchases in the future.

- Gaining a Competitive Edge:

In these competitive markets, making a statement is vital to being known. BNPL does wonders by offering options to portray a company as innovative and responsive to customer needs. This competitive edge can boost revenue growth and position the business as an industry leader, which can attract customers away from competitors.

Also read : Online Payment Security Tips for Business Owners

Importance of Auto Debit in BNPL

Let’s now understand how Auto Debit mandates an essential role in BNPL as follows:

- Ensuring Payment Reliability:

One of the most critical factors in BNPL transaction reliability is Auto Debit. Businesses can guarantee regular and prompt repayments through the automated process of deducting money from clients’ accounts. This reliability can avoid disruptions in revenue, making it crucial to preserving a sound financial flow.

- Streamlining Administrative Processes:

Automating reimbursements through Auto Debitlessens the burden of administration for companies. In such cases, there are two resource-intensive: manual monitoring and payment follow-ups. Auto Debit can streamline the whole process, which will minimise operational complexities, focus on growth strategies, and enable companies to deploy resources effectively.

- Enhancing Customer Experience:

Auto Debit helps to provide a satisfying consumer experience inside the BNPL framework. The simplicity of automatic deductions—which do not require manual payment initiation—is greatly appreciated by customers. This whole streamlined process satisfies and boosts customer experience and improves trust and loyalty.

- Enabling Predictable Financial Planning:

For those who have enrolled in BNPL, Auto Debit makes financial planning more predictable. Customers can successfully manage their budgets when they know that on the designated days, payments will be automatically withheld. This predictability improves the relationship between businesses and customers, which contributes to customer satisfaction.

- Mitigating Default Risks:

Auto Debit reduces the possibility of missed payments from the standpoint of risk management. What provides businesses with a degree of monetary security that is essential for sustained success is knowing the probability of late payments or defaults is decreased by automated and predictable repayments.

Conclusion

It is strategically necessary for a business’s financial portfolio to balance Auto Debit and BNPL. While BNPL broadens its market reach to create opportunities for revenue development, the payment method is dependable and efficient thanks to auto debit due to the increase in conversion rates and the cultivation of a devoted clientele. Together, these components form a healthy financial ecology; they lay the groundwork for a company’s long-term viability by driving revenue. Companies that become experts at striking a balance between Auto Debit and BNPL are better able to handle the intricacies of today’s financial environment and set themselves up for long-term success.

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.