Debt can weigh heavily on your life. It affects your budget, your stress level, and even your plans for the future.

Many people want to get out of debt but feel unsure where to start. The good news is that you can take clear steps to understand your situation and create a plan that works.

You don’t have to be a financial expert to make progress. You just need a straightforward approach and a willingness to stick to it.

Start by Knowing Your Total Debt

The first step is to figure out exactly how much you owe. This means listing every loan, credit card balance, and other debts.

Write down the interest rates and the monthly payments for each. When you see the total amount in one place, it can be eye-opening. It’s not meant to scare you, but to give you a clear picture of where you stand. Once you have this list, you can start deciding how to tackle the debt.

Choose a Repayment Method That Fits Your Life

There’s no single “best” way to pay off debt. Some people use the snowball method, paying off the smallest debt first to build momentum.

Others use the avalanche method, paying off the highest interest debt first to save money over time. Think about which approach will motivate you to keep going.

The right method is the one you’ll stick with until the debt is gone. Remember that small, consistent payments add up over time.

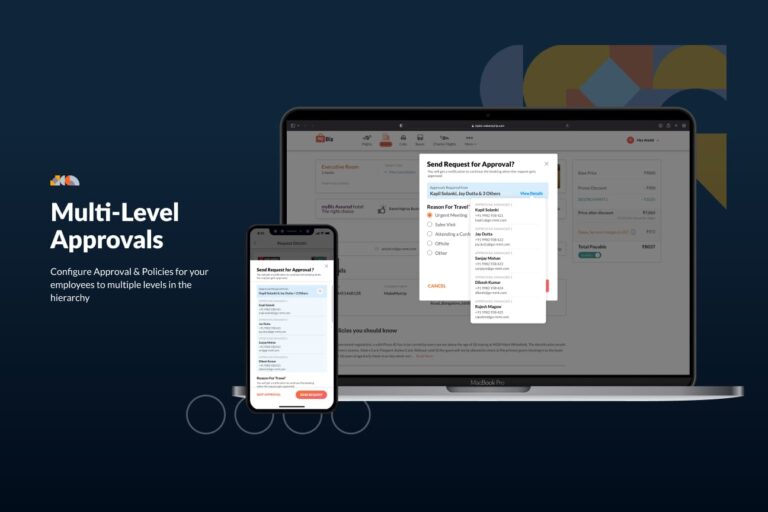

Use a Consolidation Loan Calculator to Explore Options

If you have multiple debts, you might want to see if combining them into one loan will help. A consolidation loan can replace several payments with one monthly payment, often at a lower interest rate.

Before making a decision, it’s smart to see how it would work in your situation. A consolidation loan calculator can show you your potential monthly payment, total interest, and how long it might take to be debt-free.

This can make it easier to compare your current repayment plan with the consolidation option.

Cut Costs and Free Up Extra Cash

Reducing expenses can help you pay off debt faster. Start by looking at your regular spending. Can you switch to a less expensive phone plan?

Can you cancel subscriptions you rarely use? Even small changes, like cooking at home more often, can make a difference. The extra money you save can go directly toward your debt, helping you reach your goal sooner.

Avoid Taking On New Debt

While you’re working on repayment, it’s important to avoid adding new debt. This means being mindful with credit cards and only using them for planned purchases you can pay off immediately.

If you have an emergency, use your savings instead of borrowing when possible. Staying disciplined will protect the progress you’ve already made and keep your plan on track.

Track Your Progress and Adjust When Needed

It’s motivating to see your debt balance go down. Check your progress every month and celebrate the wins, no matter how small.

If something changes in your finances, like a higher income or an unexpected expense, adjust your repayment plan. Flexibility can help you stay committed even when life throws challenges your way.

Think About Your Financial Future

Once your debt is gone, you’ll have more freedom with your money. You can build an emergency fund, save for retirement, or work toward other goals.

The habits you develop while paying off debt—budgeting, tracking expenses, and planning ahead—will serve you well for years to come. A debt-free future is more than just a number in your bank account; it’s peace of mind and the ability to make choices without financial stress

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.