In the financial landscape, cryptocurrencies have emerged as a transformative alternative to traditional currencies, propelled by blockchain technology. The importance of adeptly navigating exchanges becomes evident for those actively participating in the digital asset space, as the intricacies of these environments profoundly influence one’s engagement and decision-making capabilities.

Despite the rising appeal of cryptocurrencies, enthusiasts encounter challenges such as market volatility, regulatory uncertainties, and security concerns. An investment education firm can be a valuable resource, providing individuals with essential education. Simply visit gpt-definity.com and get started with learning.

Choosing the Right Exchange

Researching and Evaluating Different Cryptocurrency Exchanges

- Emphasis on Security Features and Measures – When selecting an exchange, prioritize platforms with robust security measures. Features like two-factor authentication, cold storage, and regular security audits enhance the safety of your digital assets.

- User Interface and Experience – User-friendly interfaces contribute to a seamless trading experience. Opt for exchanges with intuitive designs and navigation structures that cater to both beginners and experienced users.

- Supported Cryptocurrencies and Trading Pairs – Diverse offerings of supported cryptocurrencies and trading pairs allow for greater flexibility in investment strategies. Choose exchanges that align with your preferred digital assets and trading preferences.

Understanding Market Liquidity

Definition and Significance of Liquidity in the Cryptocurrency Market

Liquidity, the ease with which an asset can be bought or sold without affecting its price, is a critical factor in cryptocurrency markets. Understanding and assessing liquidity is essential for making well-informed trading decisions.

Impact of Liquidity on Trading Execution

Market liquidity directly influences the speed and efficiency of trade execution. Higher liquidity levels generally result in smoother transactions, while lower liquidity can lead to price slippage and challenges in executing trades at desired prices.

Tips for Assessing Liquidity on Different Exchanges

Evaluate the order book depth, historical trading volumes, and spread on various exchanges to gauge their liquidity levels. Opt for platforms with sufficient liquidity to ensure optimal trading conditions.

Risk Management Strategies

Importance of Risk Management in Cryptocurrency Engagement

Effective risk management is fundamental to safeguarding your digital assets in the volatile cryptocurrency market. Mitigating risks ensures a more sustainable and secure investment journey.

Setting Stop-Loss and Take-Profit Orders

Implementing stop-loss and take-profit orders automates risk management. These orders allow you to define exit points, limiting potential losses and securing profits at predefined levels.

Diversification of Investment Across Different Assets

Diversifying your cryptocurrency portfolio across various assets helps spread risk. This strategy minimizes the impact of adverse movements in any single asset class, fostering a more resilient investment approach.

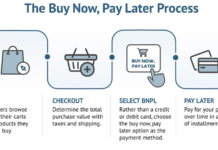

Navigating Trading Pairs

Explanation of Cryptocurrency Trading Pairs

Cryptocurrency trading pairs represent the relationship between two digital assets. Understanding these pairs is crucial for executing trades and analyzing market dynamics effectively.

Tips for Selecting and Analyzing Trading Pairs

Consider factors such as liquidity, historical price trends, and project fundamentals when selecting trading pairs. Analyze the correlation between assets to make informed decisions based on market conditions.

Strategies for Managing Volatility in Different Pairs

Volatility is inherent in the cryptocurrency market. Employ strategies such as dollar-cost averaging and setting appropriate position sizes to manage and capitalize on market volatility effectively.

Exploring Advanced Features

Introduction to Advanced Features Offered by Some Exchanges

Margin Trading

Explore advanced features like margin trading, allowing you to borrow funds to amplify your position. However, use these features cautiously, as they also elevate the risk of potential losses.

Futures and Options

Understand the concepts of futures and options trading for more sophisticated strategies. These financial instruments enable users to speculate on price movements without owning the underlying assets.

Staking and Lending Opportunities

Some exchanges offer opportunities for staking and lending, allowing users to earn passive income by participating in blockchain networks or providing liquidity to the market.

Staying Informed with Market Analysis

Importance of Staying Updated on Market Trends

Remaining informed about market trends is essential for making timely and informed decisions. Stay abreast of industry news, regulatory developments, and technological advancements shaping the cryptocurrency landscape.

Utilizing Fundamental and Technical Analysis

Combine fundamental analysis, which assesses the intrinsic value of assets, with technical analysis, which studies historical price charts and patterns. This dual approach enhances your ability to make well-rounded predictions.

Leveraging Social Media and News Sources for Market Insights

Monitor social media channels and reputable news sources to gauge market sentiment. Recognize the influence of public perception on price movements and use this information to refine your trading strategy.

Securing Your Investments

Overview of Cryptocurrency Wallet Options

Explore different types of cryptocurrency wallets, such as hardware wallets, software wallets, and paper wallets. Choosing a secure wallet is crucial for safeguarding your digital assets against hacking and fraud.

Importance of Two-Factor Authentication and Other Security Measures

Enable two-factor authentication on your exchange accounts and utilize additional security measures to enhance protection. A proactive approach to security minimizes the risk of unauthorized access to your accounts.

Safeguarding Against Phishing Attacks and Scams

Exercise caution and remain vigilant against phishing attacks and scams. Verify the authenticity of websites and communications to protect yourself from fraudulent activities seeking to compromise your digital assets.

Conclusion

In conclusion, it is crucial to recap the key considerations for navigating cryptocurrency exchanges successfully. Stress the significance of ongoing learning and adaptability in the ever-changing cryptocurrency market. Encourage readers to stay well-informed, adjust to shifts in the market, and consistently enhance their approaches. The cryptocurrency realm is dynamic, demanding a proactive and flexible mindset for sustained achievement.

Concluding thoughts revolve around the perpetual evolution of the cryptocurrency ecosystem and its potential for ongoing expansion and advancement. Recognize the transformative influence of blockchain technology and decentralized finance on conventional financial paradigms, highlighting the continuous evolution within this dynamic space.

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.