Different types of cheques

Banks offer different ways to withdraw money from an account such as using ATM, Cheque, Withdrawal slip, etc. In India, people have been using cheque for quite a long time. In this article, we will see the different types of cheques such as self cheque, bearer cheques, account payee cheques, payroll cheques, etc. and, how the cheque system works. But, let’s first have a look at what a cheque is.

What is a cheque?

A cheque is a banking instrument which is used to transfer money from one party to another party. In other words, it is a bill of exchange in which an account holder orders the bank to transfer money to another person. The person who writes the cheque is called the drawer, the bank is the drawee and the person in whose name the cheque is issued is called the payee. Money can be withdrawn from our saving account or current account using a cheque.

Features of a cheque

The cheque is an unconditional order and can be issued by any individual who holds a saving or current account. No one can change the amount written on the check at any time. The name of the payee which is written on the cheque cannot be changed later. It carries a validity only when an the account holder signs and dates it. A cheque is not valid without the signature of the account holder. If a cheque is signed but no amount is written on it, it is called a blank cheque. This is highly risky because any person can misuse the cheque if found. There will be a cheque number at the bottom-left corner of every cheque leaf. It can be used to track the status of the cheque.

How to fill a cheque?

In this digital age, the usage of cheques is declining. The younger generation is less acquainted with using a cheque. Some do not even know how to fill cheque. So, here is a step-by-step guide to filling up a cheque.

- There will be space provided at the top right corner of the cheque leaf. Fill it with the date on which the cheque is issued.

- The next line is where you write the name of the payee i.e. the name of the individual or group who you want to pay. In case of a self cheque, it should be written as “self”.

- Next, you need to write the amount you want to lay. There will be two spaces for the amount section: one in numerical figures and another in words. You need to fill them both. For instance, if you want to pay Rs. 10,000, you need to write in words again like, “Ten Thousand”.

- Sign the cheque with your signature which was used at the time of account opening. The signature should be the same. Otherwise, the cheque will be invalid.

* It is advisable not to leave the amount section blank after signing the cheque.

* A cheque should not be folded or stapled in any way.

* Do not overwrite on a cheque leaf.

* Do not leave space between words or numbers.

Validity of a cheque

The validity of a cheque refers to the time period from which the cheque is issued and considered as a valid instrument. As per RBI guidelines, this period is 3 months (90days) from the date on which the check is issued. Beyond this said period, a cheque is considered as invalid and it is called a stale cheque. In this case, you can contact the cheque writer and ask him to give a replacement cheque. A stale cheque is different from a post dated cheque. A post-dated cheque is a cheque on which a future date is written and it is not valid till the mention date. Now, lets have a look on different types of cheques.

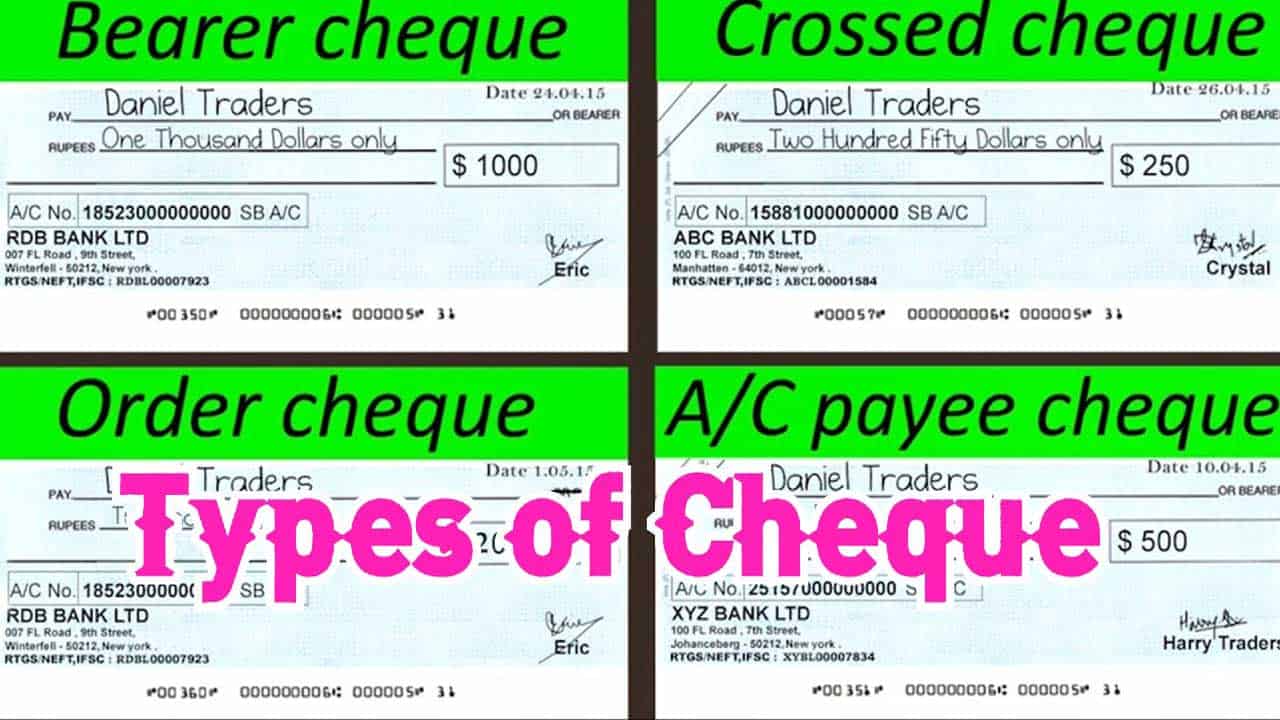

Different types of cheques

- Self cheque: As mentioned above, it is a cheque written by an account holder to himself or herself. The word “self” should be written in the space provided for the payee. It is used to withdraw cash for personal use and it can only be used in the individual’s bank.

- Open cheque: Open cheques, also known as uncrossed cheques are those which are not crossed and can be presented to the drawee’s bank to pay the person who is presenting the cheque. The payee should also sign on the back of the cheque while receiving the amount.

- Traveller’s Cheque: Traveller’s cheques are pre-printed, fixed-denomination cheques used by travellers as a secure and convenient alternative to cash. They require the traveler’s signature for encashment and can be replaced if lost or stolen.

- Banker’s Cheque: A banker’s cheque, also known as a cashier’s cheque or a bank draft, is issued by a bank on behalf of its customer. The bank guarantees the payment as it debits the customer’s account and makes the payment to the payee when the cheque is presented.

- Post-dated Cheque: A post-dated cheque carries a future date on it. It cannot be encashed or deposited before the specified date. The cheque becomes valid for payment on or after the mentioned date.

- Stale Cheque: A stale cheque is a cheque that is presented for payment after a certain period, typically six months from the date mentioned on the cheque. Banks usually do not honour stale cheques, and the payee must obtain a fresh cheque from the issuer.

- Bearer Cheque: A bearer cheque is payable to the person who presents it for payment. The cheque does not mention any specific payee’s name, and it can be encashed by anyone who possesses it.

- Order Cheque: An order cheque is payable to a specific person or organisation named on the cheque. Only the specified payee can encash or deposit the cheque. The payee must endorse the cheque by signing on the back before it can be deposited into their account.

- Crossed Cheque: A crossed cheque has two parallel lines drawn across its face. This crossing signifies that the cheque can only be deposited into a bank account and cannot be encashed directly. It adds an extra layer of security by preventing the bearer from receiving cash directly.

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.