Credit Score

A credit score is nothing but a 3-digit numerical representation of your credit profile that financial institutions use to determine whether you qualify to avail a credit card or loan. Credit agencies use distinct credit scoring formulas to decide your score. While your score might differ, the variables that every credit bureau factor in are the same.

To compute your score, credit bureaus consider your distinct algorithms. There are four major bureaus namely CRIF High Mark, CIBIL, Equifax and Experian. All such bureaus have distinct scoring models and thus, your score might differ from one bureau to another. You can simply check free CIBIL score, Experian score, Equifax score and CRIF High Mark score by visiting their respective websites. The reason for your credit score to be different is that the banks and lenders might not report your banking activities to the concerned bureaus on time.

Read on here the distinct parameters that are factored in to compute your score.

Parameters used for your credit score computation –

So, before you move ahead to check CIBIL score online, note that you are aware of the important parameters that form your score. Here are the top four parameters that are utilised for computing your score. The weight that every constituent has in reference to how it impacts a score computation can change based on the scoring model used by the bureaus.

Repayment history –

Personal loans, credit cards, bike loans, home loans, auto loans, etc. all are added to your repayment history. Your past repayment record list down facts on your missed or late repayments, bankruptcies and info linked with how you have conducted your repayments against debts you hold. Credit score algorithms often factor in your repayment history, the amount due and how frequently you missed out on your repayments.

Credit utilisation ratio (CUR) –

Your CUR (credit utilisation ratio) is the next important parameter that plays an important role in computing your credit score. Your credit utilisation ratio is the overall credit amount used by you against your overall available credit. If your credit utilisation ratio is over 30 per cent, your score may get affected. So, ensure to maintain a CUR (credit utilisation ratio) of within 30 per cent if you are looking to ameliorate your score.

The overall number of credit accounts –

The kind of mix of credit you have in your credit portfolio even affects your credit score computation. Holding a distinct variety of credit products like home loans, personal loans, auto loans and loan against credit cards allows in boosting your score. Thus, the overall number of credit accounts you hold is factored in for computing your credit score.

Age of credit –

The older your credit card or loan, the better it is for you to compute your credit score. Avoid closing your old accounts even if you have repaid your debt. Lenders can simply make an informed choice regarding whether to grant the credit if you hold a long credit record. As an outcome, it is suggested you maintain and keep your older credit accounts open.

Here’s a deep dive into how much impact such parameters have in computing your score –

· Repayment history – high impact

· Credit age – Medium impact

· Credit utilisation ratio – high impact

· Overall number of credit accounts – low impact

Parameters that are not factored in when computing your credit score –

It is important for you to understand that your score simply shows the details linked with your credit report. Banks or lenders take additional data into account when evaluating your credit profile. There are other important details like your current income, age, and employment tenure that are also factored in for computing your credit score.

The score range of distinct credit bureaus –

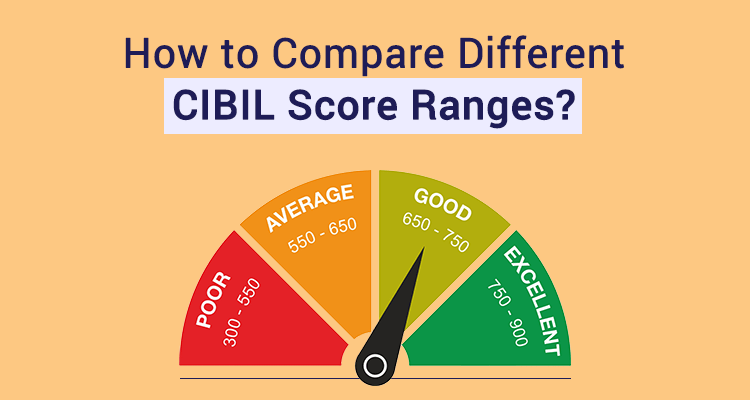

CIBIL score range –

| CIBIL score range | Credit rating |

| 300 – 550 | Poor |

| 550 – 650 | Average |

| 650 – 750 | Good |

| 750 – 900 | Excellent |

Experian score range –

| Experian score range | Credit rating |

| 300 – 500 | Very low |

| 500 – 650 | Low |

| 650 – 750 | Good |

| 750 – 850 | Very good |

| 850 + | Excellent |

Equifax score range –

| Equifax score range | Credit rating |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 699 | Very Good |

| 800 – 850 | Excellent |

CRIF High Mark score range –

| CRIF High Mark score range | Credit rating |

| 300 – 500 | Very low |

| 500 – 650 | Low |

| 650 – 750 | Great |

| 750 – 900 | Excellent |

What is a strong credit score?

Typically, most lenders consider your score of 750 and above as good. However, every lending institution usually has its own specific system for evaluating credit risk. For example, a financial institution might approve your loan application if your score is over 750 while another financial institution might consider a credit score of over 700 to be ideal for lending.

However, lenders depend heavily on your score. Thus, it is important for you to assess your report periodically and maintain a strong score.

How is your credit score computed?

Your credit score is usually computed based on distinct parameters by the bureau. These include –

Your repayment track record

In the case of late repayment or any defaults of your EMI (equated monthly instalment), it can negatively affect your credit score. It is looked upon as one of the crucial parameters while computing your score.

Credit utilisation ratio

High usage of credit periodically shows you as an applicant depend heavily on credit and another unwanted incident, which may be responsible for pushing you towards loan defaults. A low CUR (credit utilisation ratio) of less than 30 per cent is considered preferred by lenders.

Multiple enquiries

Multiple enquiries show you as a credit-hungry and desperate individual. Lenders are particularly reserved towards accepting the credit applications of these loan applicants. Thus, it is suggested that you make hard enquiries just when you are thoroughly sure of availing a loan.

Number of credit applications availed as well as applied

Credit bureaus ensure to keep a thorough track of the loans that you have applied for previously and the number of loans that got accepted. In the case, loans were turned down, it can have a negative impact on your credit score.

Mix of credit

You must have a balanced mix of unsecured and secured credits to form a good credit history. However, this parameter has low weightage when it is linked with computing your credit score.

Write and Win: Participate in Creative writing Contest & International Essay Contest and win fabulous prizes.