credit score

Introduction to credit score:

Money is not something that can buy you happiness. But certainly, it can buy things that will make us happy. Hence money is a very crucial thing in life. There are ample opportunities to earn money. Sometimes, we work harder to accumulate our own money. But at times, we need lump-sum money that we immediately cannot gather.

So, to help us, there are always institutions like banks. Banks always give the seeker loan based on certain conditions. The credit score that a person holds determines how easily one can avail loan from the bank. Credit Score is nothing but our borrowing power. In this article, we will be discussing the factors that will help you keep a good credit score to avail credit loan.

An education loan is a loan borrowed required for higher education related fee or other expenses. credit score plays a vial role in getting such loans which pave he future of our child.

What is a Credit Score?

A credit score is a unique three-digit number. With the assistance of this number, the money lenders calculate or assume the risk of lending money to a seeker or borrower. For any person or institution that lends money like mortgage banks, or credit card companies, this is a very important number.

Evaluating this number, they determine how much amount of money one can borrow as debt and at what interest rate. Also, it is of great importance to the landlords and the insurance companies to assume how financially capable you can be if you face a debt. debt management is extremely important and it should be planned wisely.

Factors affecting your credit score:

Here are the five most crucial factors that have an insightful impact on your credit score. Also, we would discuss the implication of credit scores while applying for loans through collection agency near me.

Before that, one needs to have a clear idea of what counts towards your credit score.

The implication of Credit Score:

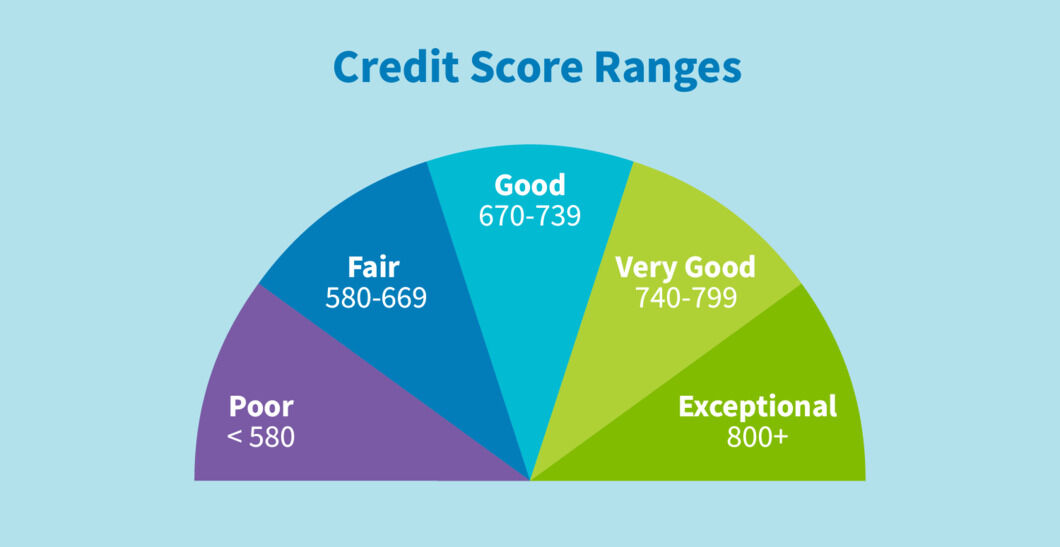

The credit score of a person implies their previous history of financial stability. It also determines a calculation of the person’s credit management. The range of the score is 300- 850. The credit agencies compile your credit score based on your credit file information. The most popular one is the FICO score, a FICO score of 8 to be more specific. Besides, there are also other scores like VantageScore.

Here are 5 factors that positively contribute to making up your FICO Score 8 for your credit loan.

- Payment History (around 35%):

The most important part of your credit score is your payment history. It explains your previous history of success in compensating the debt that you have loaned. Your credit score indicates the following factors-

- Paying bills on time as mentioned in the credit report.

- If any, the tenure of your late payment. (30/60/90 days or more) later return results in a worsening of the score.

- Any history of the account being sent to collections. This indicates your possible incapability to clear your debt.

- Any history of charge or debt settlements. Or if there is a previous record of bankruptcies or lawsuits. If there is any, mark it as the worst thing for you to your money lender. They might decline your request of borrowing money straight away.

- The count of the last negative event and the number of times one missed the payments. For example, a person is in a better position who missed their credit card payment 4 years back than anyone who has missed it this year.

- Amount Owned (around 30%):

The second most important factor to affect your credit score is your potential to avail of the loan. The FICO Score 8 takes into account one’s credit utilization ratio. It is the ratio of your credit limit to your amount of debt. Below is a clear explanation of this in points-

- The usage ratio of your available credit. A higher credit utilization ratio is less likely to convince your money lender about your capability of managing more debt.

- Owing to the specific type of accounts. Whether your account is an auto loan or a mortgage? Or it is installment accounts or credit cards. This identifies your capability of managing various accounts at the same time.

- The ratio of how much you owe to that of the original amount on the account of installation. Here lesser the ratio better is the opportunity of availing of loans. For example, a credit score of $100 against a $10000 limit is always better than a credit score of $8000 against a limit of $10000.

- Credit History Length (around 15%):

This is the period that lenders look for. This factor determines your possible chances of availing of a credit loan. This factor includes the length of time for your obligation, and how old your accounts are.

Longer credit history is always beneficial for borrowing further loans. But there is a negative side to this as well. A borrower with short history implies that they can make payments on time and do not owe much more than their capability.

This is why it is wise to keep your credit card amount open even when it is not in use. As the account age, they will boost the credit score. Closing your oldest account of any credit account, you will see the overall credit score decline all at once.

New Credit (around 10%):

This FICO Score 8 accounts for the number of new credit accounts you open. It also accounts for how recently you have applied and when was the last time you opened an account.

Whenever one applies for a new account, they need to grow through the hard inquiry that the lenders do. Now, this can result in a small and temporary decline in the credit score. As this inquiry identifies the number of accounts you have opened recently, by assumption you represent a higher credit risk. It implies that you do not have a better understanding of your money management.

Types of Credit in use (around 10%):

This implies the various accounts you owe and the mixed credit value of all that accounts. This is a very small component of your credit score. It is okay if you do not have accounts of all types. And never use this unwise decision of opening new credit accounts just to enhance your mixed credit types.

Factors that do not impact your Credit Score for Credit Loan:

We have discussed above the factors that are crucial to determining your credit score to apply for a loan or to compensate for a debt. Now there are many other things that you have to mention while fulfilling the form. The factors that do not influence your credit score are as follows-

- Marital status

- Social background

- Age

- Monthly income

- Employment history

- Residence

- Public assistance report

- Family obligations

- Participation in credit counseling programs

How to improve your credit score:

Here are some important points you need to keep in mind to improve your credit score.

- Keeping credit utilization ratio below 15%-25% of your available credit.

- Repay your debt on time and if not possible, do not delay more than 30 days.

- Not to open new accounts within 12 months of opening one account.

- Keep a check on your credit score at least 6 months in advance before making a bigger purchase. Especially when you need a loan to avail of a purchase, it is very important to have a pre-plan.

- Anyone can have problems handling credit accounts. So having a bad credit score or a flawed history is very common. There is nothing to despair about. You will learn to make better choices as you grow. But make sure you cling to learning and do not leave it midway.

Conclusion:

These days the expenses of everything are on a high rise. And the standard of living, as well as the cost of living, has enhanced eventually. So we have dreams to fulfill but are often short of accumulating all the money at once for that. This is why we avail for loans. And before availing of loans, this article will help you to know all the basics about that.

FAQ:

- What is the use of FICO Score 8 for a lender?

Ans: FICO Score 8 is the most accepted and widely used credit score in all fields. About 90% of the lenders use this score to measure the availability of the amount of loan in what interest rate to their lenders. Another important and used version of FICO Score 8 is FICO Score 9.

- How to collect my credit report for free?

Ans: One having a credit account can visit AnnualCreditReport.com at any time. Every credit account holder has the legal entitlement of deriving one credit report for free. There are three credit bureaus: Experian, TransUnion, and Equifax. One is eligible to draw one free credit report from each one of the credit bureaus every year.

- What is the range of a good FICO Score 8?

Ans: A FICO score 8 which is 700 and above is good for availing credit loans. They can qualify for lower interest rates.