Solar Panels

Are you considering installing solar panels on your home or business? Not only can it have a positive impact on the environment, but it could also be a smart financial move. By taking advantage of tax breaks and incentives offered by the government, you could save thousands of dollars in the long run.

In this blog post, we’ll explore why installing solar panels is not only good for the planet but also for your wallet. So let’s dive in!

What is Solar Energy?

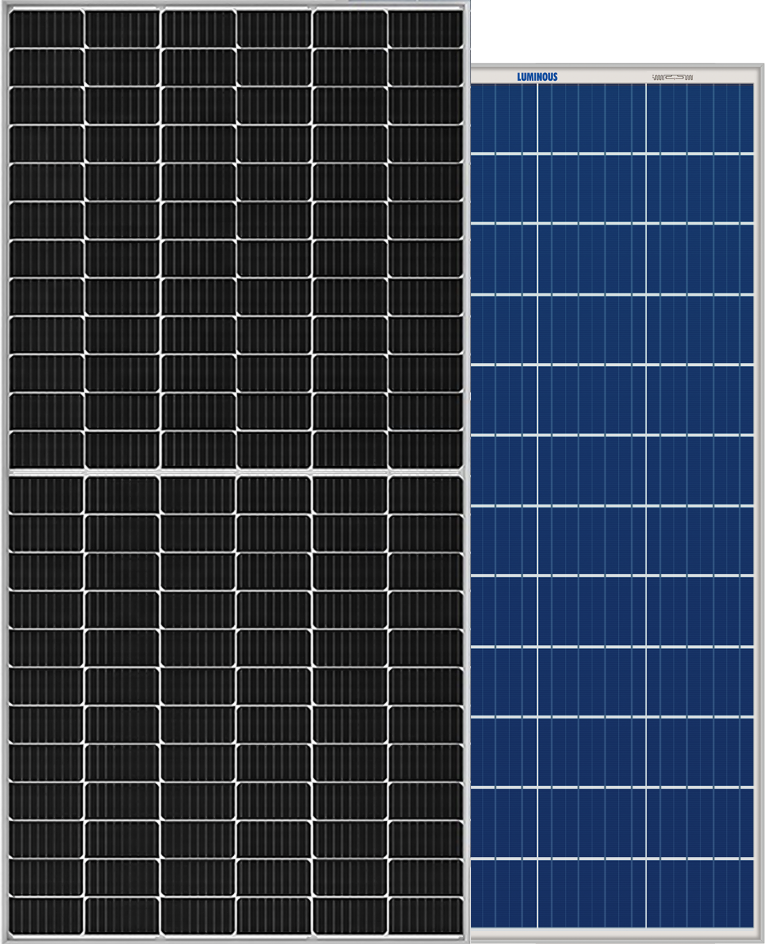

One sort of renewable energy that originates from the sun is solar energy. Solar panels are used to collect and convert sunlight into electricity. Solar power is a clean and environmentally friendly source of energy, and it’s becoming increasingly popular as a way to reduce reliance on fossil fuels and lower electric bills. Top Solar Panels Ireland is your trusted partner in transitioning to clean energy. With their state-of-the-art solar panels, power your home with the sun’s energy and contribute to a sustainable planet.

There are several reasons why installing solar panels can be a smart financial move. One is that solar panel systems have become much more affordable in recent years, thanks to advances in technology and manufacturing. Another is that many governments offer generous tax breaks and other incentives for people who install solar panels.

In the United States, for example, there is a federal tax credit worth 30% of the cost of installing a solar panel system. There are also numerous state and local incentives available. These incentive programs can significantly reduce the upfront cost of going solar, making it an even more attractive investment.

Of course, the financial benefits of installing solar panels will vary depending on your individual circumstances. But if you’re looking for ways to save money on your electric bill and do your part to help the environment, going solar is definitely worth considering.

Benefits of Solar Energy

There are a number of federal and state tax breaks currently available for those who install solar panels. The most common is the Solar Investment Tax Credit, which offers a 30% tax credit for both residential and commercial installations. There are also a number of property tax exemptions and credits available in many states.

Solar energy offers a number of advantages over traditional forms of energy generation. It is clean, renewable, and has the potential to significantly reduce your carbon footprint. Additionally, solar energy can save you money on your electricity bills, and may even increase the value of your home.

Tax Incentives for Installing Solar

If you’re considering installing solar panels, there are a few tax incentives for solar that could make the decision even more financially attractive. First, the federal government offers a tax credit equal to 26 percent of the cost of your solar panel installation. There are also many state and local governments that offer additional tax credits and rebates.

Second, if you install solar panels on your home, you may be eligible for a property tax exemption. This can vary significantly by state, but in some cases, you may be able to exempt up to 100 percent of the increased value of your home from property taxes.

If you generate more electricity than you use (i.e., you have “net metering”), you may be able to sell this excess electricity back to your utility company at a profit. Net metering laws vary significantly by state, so be sure to check with your local utility company to see if this is an option in your area.

Types of Solar System Installations

There are three types of solar system installations for homes and businesses: grid-tied, off-grid, and hybrid.

Grid-tied systems are connected to the electric utility grid and use solar power to supplement energy usage from the grid. These systems can provide backup power during a grid outage. Off-grid systems are not connected to the electric utility grid and rely solely on solar power. Hybrid systems are connected to the electric utility grid, but have battery backup for when the grid is unavailable.

Solar photovoltaic (PV) systems come in a variety of sizes, from small 2 kilowatt (kW) residential PV systems that can offset a portion of your monthly electricity bill, to large 200 kW commercial PV systems that can provide all the electricity for a business or office building. There are also larger megawatt (MW) sized ground mounted solar farms that supply power to the electric utility grid.

How Much Do Solar Installation Cost?

The cost of solar installation has come down significantly in recent years, making it a more attractive option for homeowners looking to go green and save money on their energy bills. There are a number of factors that affect the cost of installing solar panels, including the type and size of system you choose, the location of your home, and the availability of government incentives.

The average cost of a solar panel system in the United States is around $3 per watt, meaning a 5 kilowatt (kW) system would cost around $15,000 before any tax breaks or other incentives. However, the cost of solar has been falling rapidly in recent years and is expected to continue to do so as technology improves, and more people adopt renewable energy.

There are a number of different government incentives available for those who install solar panels, including tax breaks at both the federal and state level. These incentives can significantly reduce the upfront cost of installing solar, making it an even more attractive option for those looking to go green and save money.

Financing Options for Installing Solar

If you’re thinking about installing solar panels, there are a few things you should know about financing options and tax breaks. Here’s a look at some of the most important things to consider.

Solar panel installation can be a significant upfront investment. However, there are several financing options available that can make going solar more affordable. For example, many solar companies offer lease and power purchase agreement (PPA) options, which can help spread out the cost of installation over time. There are also a number of state and federal tax incentives that can make solar more affordable, including the federal Solar Investment Tax Credit (ITC).

When considering financing options for solar, it’s important to compare the total cost of ownership (TCO) across different options. The TCO takes into account not only the upfront cost of installation, but also the ongoing maintenance and electricity costs over the life of the system. Comparing TCOs can help you identify the option that will save you the most money in the long run.

State and federal tax incentives can play a big role in making solar more affordable. Incentives like the ITC can make a significant difference in the upfront cost of installation. Be sure to research what incentives are available in your area before making any final decisions about going solar.

Conclusion

In conclusion, installing solar panels in your home may be a smart financial move. Not only can it help you save money on your bills, but also the government offers tax credits and other incentives to further reduce costs. If you’re thinking of going solar, it’s important to do research and understand all the potential benefits before taking the plunge. With careful consideration and an eye for detail, this could be a great option for those looking to save money while helping out the environment at the same time!